While Amazon continues to grow, its penetration into the most affluent households has decreased over the past year, according to new research from the Shullman Research Center.

Luxury brands continue to ostracize the retailer, worried that its counterfeit goods and tendency to discount would hurt the brand too much to justify the revenue increases. Nevertheless, affluent classes’ growing affinity for the marketplace provides a provocative counterpoint arguing for its eventual integration into the luxury industry.

“[The relative threat of counterfeit goods versus selling merchandise on Amazon] really depends upon the clout of the luxury brand and the deal it can negotiate with Amazon,” said Bob Shullman, founder and CEO of the Shullman Research Center. “My current take is that Amazon really wants to sell merchandise with high dollar margins (luxury type items) and then take their percentage cut of the sales price.

“But for the brands to sign up with Amazon, there can be no unilateral discounting by Amazon,” he said. “It’s got to be a relationship with the brand having ultimate control.

“Plus there needs to be an agreement on what other merchandise gets shown next to the luxury brand’s merchandise. Last but not least, Amazon has to address the counterfeiting issue.”

“Is Amazon Coming Into Its Prime?” data was gathered through a survey of 1,690 consumers and 1,078 interviews of consumers across four different income levels in roughly equal numbers.

Customer support

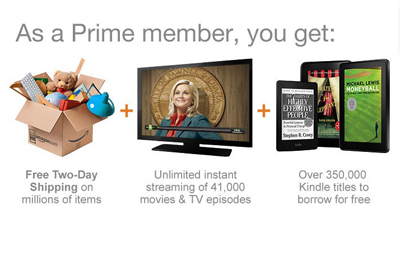

Compared to last year’s study, Amazon shopping has decreased among consumers in the $250,000-$499,999 bracket and the $500,000+ bracket. Conversely, the percentage of consumers who shop at Amazon at least once a month grew among all income brackets and was highest among higher income households.

Similarly, Amazon Prime enrollment increased, to 41 percent of Amazon customers from 32 percent last August, with growth most apparent in the $75,000-$249,999 and $250,000-$499,999 brackets. Notably, the number has dropped among the top 1 percent of consumers – those earning at least $500,000 – as this segment appears to have waned off Amazon since last August.

The drop in Amazon usage is likely due to service. Last August 83 percent of these consumers said Amazon is better than other places they shop, compared to only 64 percent of all Amazon customers who felt that way. This year shows that Amazon satisfaction has increased, with 73 percent agreeing now, but agreement among the top 1 percent has dropped 10 percentage points.

While Amazon’s intent to enter the luxury market has long been the elephant in the room, the changes in the sentiment of the highest earners – and the most frequent luxury purchasers – suggests that service remains a point of differentiation for luxury brands. If brands focus on providing excellent service in ways that Amazon cannot, they can prevent or prolong the giant’s entry into luxury.

While Amazon usage among the top 1 percent might be falling, the numbers are still high, and are growing among the next two income brackets. Consumers in those brackets are just as likely to have purchased a personal luxury good in the past year, with the most affluent differentiated primarily because of increased spend on fine wine/beer/spirits, cruises/vacations and vehicles.

The data therefore shows that brands would likely see good sales returns from selling on Amazon. However, the damage to the brand reputation in being sold alongside counterfeit goods, being listed alongside non-luxury products and in the possibility of Amazon discounting at its own discretion has led brands to believe that avoiding the platform altogether is the safer move.

“It really depends on the brand and how important their customers and prospects feel about the issue of ‘exclusivity,’” Mr. Shullman said. “Right now, for the really high end brands, they don’t want their very high quality, expensive shirts to be shown next to $16 mainstream shirt.

“I believe we all understand that issue and Amazon has to deal with it,” he said.

Additionally, with luxury-specific marketplaces such as Yoox and Net-A-Porter providing these security and comfort checks, brands likely feel that their highest spenders already have an ecommerce marketplace offering luxury goods.

Counterfeit controversy

Because Amazon is a marketplace, it holds no direct responsibility for consumers duped by counterfeit goods, and even gets a cut of the sale.

As a result, Amazon’s counterfeit problem is only getting worse, as the company’s efforts to curtail fakes fall short.

Tightly distributed luxury brands tend to avoid Amazon as a selling platform to keep their positioning in tact, but many end up having a presence on the marketplace whether they want to or not, as counterfeiters sell goods using their name. While Amazon does have a counterfeit policy, the general feeling is that the company could be doing more to protect brands and consumers from illegal copycats (see story).

While there may not a single silver bullet solution to end counterfeiting, technological methods may be able to curb the practice.

In a white paper prepared by the Coalition Against Illicit Trade (CAIT) titled “The Role of New Technologies in Combatting Counterfeiting and Illicit Trade,” the business alliance seeks to raise awareness for the technology solutions available to fight the knock-off market. In an environment of rapid digitalization, these solutions will benefit not only brand owners and service providers, but also governments that are plagued by illicit tax-free trade and consumers (see story).

“In my estimation, it is up to Amazon to make the first move,” Mr. Shullman said. “If it really want to be in the luxury world, I believe it needs to create a separate luxury site that looks like a luxury brand’s or luxury retailer’s site (a la Net A Porter, etc.).

“Commingling high-end luxury goods with mainstream items will not work for virtually all the luxury brands,” he said. “Then Amazon needs to work out deals with the luxury brands that honor their concerns and guarantees Amazon will follow through on the deals.

“Feasible? In my estimation, it is all up to Amazon and its desire and plans to service the luxury brands and Amazon’s many millions of consumers (upscale and mainstream) who currently buy luxuries through other channels.”

from

http://redirect.viglink.com?u=http%3A%2F%2Fredirect.viglink.com%2F%3Fu%3Dhttps%253A%252F%252Fwww.luxurydaily.com%252Famazon-maintains-market-but-counterfeiting-discounting-prevent-luxury-entry%252F%26key%3Dddaed8f51db7bb1330a6f6de768a69b8&key=ddaed8f51db7bb1330a6f6de768a69b8

No comments:

Post a Comment